Unfinished regulations delay govt’s plan to carbon tax PLTUs

The government has delayed implementation of the carbon tax for coal-powered power plants (PLTUs) from April 1 to July due to incomplete regulations. The government seems to be in a dilemna over carbon taxing PLTUs and other carbon-intensive industries, fearing that it could derail economic recovery as the tax would result in higher production costs, which would eventually cause an increase in prices of goods and services.

Announcing the delay in carbon tax implementation, Finance Minister Sri Mulyani Indrawati said her ministry was coordinating closely with other ministries and government agencies in implementing the carbon tax to make sure that “the implementation would not disrupt the ongoing economic recovery” from the impacts of the pandemic.1

The carbon tax, first introduced by the 2021 Tax Harmonization (HPP) Law, requires a number of regulations to implement. The government issued the Presidential Regulation (Perpress) No. 98/2021 on the economic value of carbon during the global climate summit in Glasgow last November, but more regulations at the ministerial level are still required.

The Finance Ministry is still preparing to implement carbon tax-related regulations, including calculation, collection, payment, reporting and a carbon tax roadmap. Meanwhile, the Energy and Mineral Resources Ministry is drafting regulations on PLTUs’ carbon value and emission caps. Until the regulations at the two ministries are ready, the carbon tax cannot be implemented.2

In the meantime, the Coordinating Maritime Affairs and Investment Ministry is tasked with establishing a steering committee on the economic value of carbon, while the Environment and Forestry Ministry is drafting regulations on the economic value of carbon and the Nationally Determined Contribution (NDC). The NDC is part of Indonesia’s Paris Agreement commitment to a 29 percent reduction in greenhouse gas (GHG) emissions by 2030 through independent efforts, or 41 percent with international financial support – from a predicted emission equivalent to 2.869 billion tons of carbon dioxide (CO2).

The government’s urgency regarding the carbon tax is related to Indonesia’s vulnerability to the impacts of climate change, as an archipelagic country with most of its population living in its islands’ coastal areas. Moreover, the carbon tax is one of the government’s new means to collect more revenue for its distressed budget,3 and most of all, to impress G20 leaders who will gather in Bali in November this year.

The Indonesian government has included sustainable energy transition as one of the three main agenda of its G20 2022 presidency, along with global health architecture and digital transformation.4 Indonesia would be the second country in Southeast Asia after Singapore to adopt the carbon tax, and thus, would show its leadership in the energy transition agenda. At the same time, Indonesia is demanding developed countries to help finance Indonesia’s costly energy transition from fossils – mainly coal – to renewables.5

The carbon tax will first be levied on PLTUs with capacity of over 100 megawatts. The government said PLTUs under 100 MW would be exempted this year as electricity supply to communities should not be disrupted, especially for those outside Java.6 After addressing the PLTUs, the government plans to slap the carbon tax on other carbon-intensive industries such as pulp and paper, cement and petrochemicals.

According to the HPP Law, the carbon tax rate is set at a minimum of Rp 30,000 (US$2.10) per ton of CO2 equivalent (CO2e) or Rp 30 per kg of CO2e. Not only is this rate less than half the figure initially proposed (Rp 75/kg CO2e) but it is also significantly less than the International Monetary Fund (IMF) and World Bank’s recommended carbon tax rate for developing countries -- between US$30-100 per ton of CO2e.

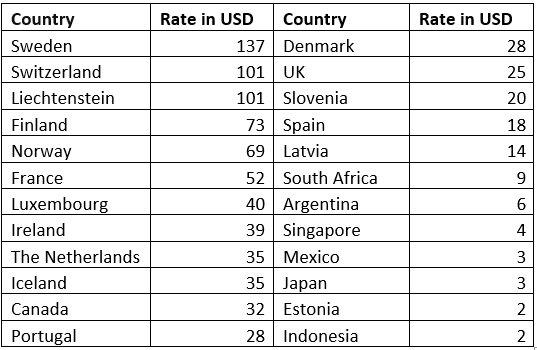

The tariff is also one of the lowest tariffs in the world compared with other countries implementing similar measures. With a carbon tax rate of $2.1 per metric ton of CO2e, Indonesia’s rate is comparable to that of Japan, with a tariff of $2.65 per metric ton of CO2e. Carbon tax rates vary greatly around the world, with Sweden having the highest rate at $137 per ton of CO2e and Poland the lowest rate of below $1.7

Sri Mulyani said that to tackle climate change, the ideal rate should be around $125 per ton. But it would be almost impossible to achieve a global agreement on such a high rate.

Carbon tax rates by countries, 20218

PREV NEXT